Food and agriculture companies are experiencing an uptick in interest in how they engage their supply chains to future-proof their business and protect nature. This scrutiny is forcing companies to address their negative impacts and transform into regenerative and just models

In order to better understand how this changing landscape is driving supply chain traceability at food and agriculture companies, I spoke to Montana Stevenson, a responsible sourcing consultant with previous experience at Danone, as well as Katelyn Thacker and Ashley Wallace from sustainable supply chains solution provider BanQu.

Regulators’ sticks and carrots

The European Union and the United States have taken different tacks to encourage companies to get serious about traceability. The EU has relied more on policy regulation (the stick) while the U.S. has focused on payments and subsidies (carrots). Here are the critical ones from each adding urgency to companies’ attempts to trace supply chains:

EU Corporate Sustainability Reporting Directive (CSRD): About 3,000-plus American companies that operate in Europe must be prepared to deliver CSRD reports to the EU between 2025 and 2029 (depending on their size). In the Biodiversity and Ecosystem Services Standard, ESRS E4, one disclosure requirement explicitly requires traceability to a company’s raw materials due to a business’s local impacts and dependencies on nature.

EU Deforestation Free Regulation (EUDR): The EUDR represents an expansion of laws that focus on timber products from deforestation caused by illegal logging. It will require any company importing or exporting seven specific commodities (cocoa, coffee, soy, palm oil, wood, rubber and cattle) and their derivatives to and from the bloc to be able to prove that these products did not come from land deforested after 2020.

USDA’s Partnerships for Climate Smart Commodities: This federal program from the U.S. Department of Agriculture represents the first significant step-up of funding for sustainable agriculture in the United States. The program provides $3.1 billion in public investment and incentives for developing commodity supply chains that can verify that the crops are produced using a suite of climate-smart agricultural practices.

Transparent supply chains increase sustainability’s business case

Companies that achieve product-level traceability can level up from today's leading regenerative agriculture commitments. They will be positioned to capitalize on the business opportunities that sustainability promises. As of today, PepsiCo’s commitment to scale regenerative agriculture across 7 million acres — approximately equal to its entire agricultural footprint — by 2030 is a best-in-class example.

However, the 7 million acres the company will support for the implementation of regenerative agriculture are not the exact 7 million farm acres from which PepsiCo sources. Rather, they are from across the company's key sourcing regions. This reduces the potential upside of the company's efforts as it can neither optimize across departments based on shared data nor authentically market its products as regenerative to customers.

Companies will be ill-prepared to deliver their public commitments and respond to sophisticated investor questions if they do not have commodity-level traceability from farm to shelf.

As nature and biodiversity continue to move up the mainstream agenda and businesses gain a better understanding of local impacts and dependencies — versus the global impact of greenhouse gas emissions and removals — the case for traceability grows.

How to accelerate your traceability initiatives

I believe forward-looking companies will prioritize investments in traceability to get ahead. As of March, Planet Tracker was only able to identify nine companies in the food industry that have a head of traceability. This job function is critical for driving the holistic implementation of traceability.

Traceability is hard work. Following a product’s supply chain across the globe can seem impossible when approached as a single activity. Both Stevenson and Thacker emphasized that breaking a traceability initiative into a series of smaller steps creates momentum and learning to reach the ultimate goal.

Many companies have skipped the step of tracing their supply chain to set place-based baselines because implementing supply shed solutions is both easier and sexier. These initiatives have helped companies build their sustainability reputations, making them worth the investment. Yet, we know that you know you can’t manage what you do not measure. Traceability needs to be the first step so companies can set accurate baselines to underpin transformational strategies.

I found it revealing that Stevenson, Thacker and Wallace all referenced the same set of four approaches when discussing how companies can set themselves up for future success:

Engage employees across departments. Get sustainability, procurement, marketing, legal and finance working hands-on with the data to see the value transparency can bring. Having the data won’t lead to business opportunities without buy-in across the company.

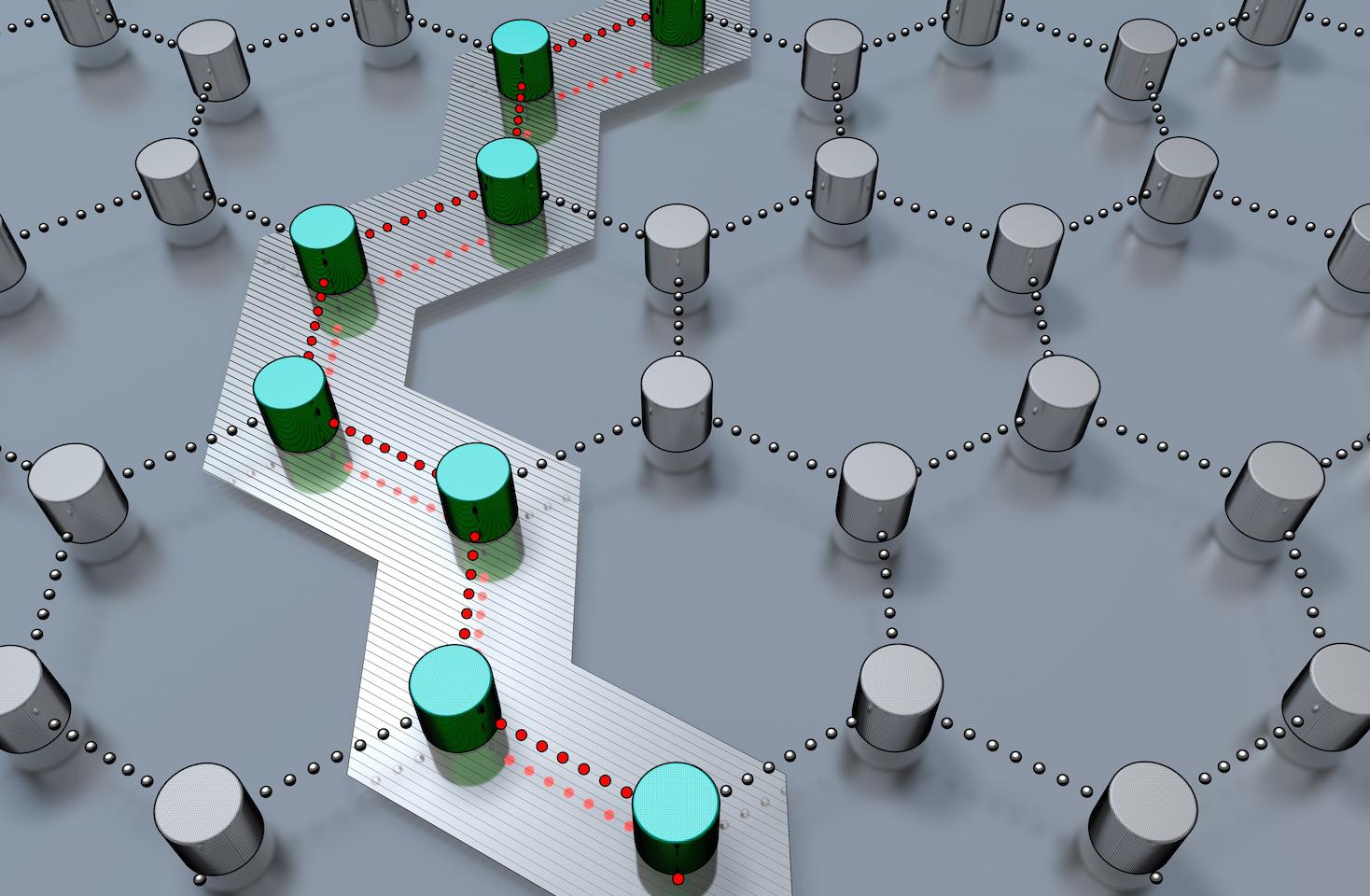

Use emerging technologies for digital infrastructure. Interoperability is crucial given the variety of data types and sources a company needs to collect along its supply chains. Products such as the ones offered by BanQu that can integrate data from a variety of sources — such as SMS messages from smallholder farmers and remote sensing geospatial data to agronomist inputs while respecting privacy concerns — will deliver more value over time.

Simplify your supply chains where you can. The fewer nodes in your supply chain, the easier it is to trace. For example, Mars reduced the number of palm oil mills it works with to less than 100 from over 1,500 between 2019 and 2021. Be sure to approach simplification through a just transition lens to avoid negative effects on communities.

Start small and soon. Build up your capabilities by working on one or a few essential commodities first. Start soon, as regulators and consumers will give brands less slack over time. The window to get ahead is closing.

Translating traceability into value

Tracing supply chains to comply with regulations may not be incentive enough for some companies. So, what additional value can agriculture and food companies unlock?

First, agri-food investors are waking up to the systemic risks in the food system. The Financial Markets Roadmap for Transforming the Global Food System by Planet Tracker outlines six priority actions for financial institutions starting with requiring fully traceable supply chains. This directive comes before measures like halving food loss and waste, stopping deforestation and making production systems regenerative that have dominated food companies’ public commitments.

Companies will be ill-prepared to deliver on their public commitments and respond to sophisticated investor questions if they do not have commodity-level traceability from farm to shelf.

Second, consumers — especially younger generations with an increasing share of purchasing power — are becoming aware of the impacts of their food choices on their health and the planet’s health. Companies with product-level impact and practice details — which are only provable with a chain of custody from the farm to the shelf — will have a strategic marketing advantage.

Whether your company fears the sticks or enjoys the carrots, it is time to stop acting like an ostrich and pull your head out of the sand.